Closing Costs for Homebuyers: What You Need to Know on Long Island, NY

Buying a home on Long Island, NY, can be an exciting and fulfilling experience, but it can also be expensive. One of the expenses that you need to consider when purchasing a home is closing costs. Closing costs are expenses that are incurred in the process of transferring the ownership of a property from the seller to the buyer. In this article, we'll explore what closing costs are and what you need to know about them as a homebuyer on Long Island, NY.

What Are Closing Costs for Buyers on Long Island?

Closing costs for homebuyers on Long Island, NY, typically include a variety of fees and expenses associated with the purchase of a property. These can include:

- Attorney fees

- Title insurance

- Home inspection fees

- Appraisal fees

- Survey fees

- Mortgage fees

- Recording fees

- Transfer taxes

The total amount of closing costs for homebuyers on Long Island, NY, can vary depending on the purchase price of the property, the type of property, and other factors.

How Much Are Closing Costs in NY for Buyers?

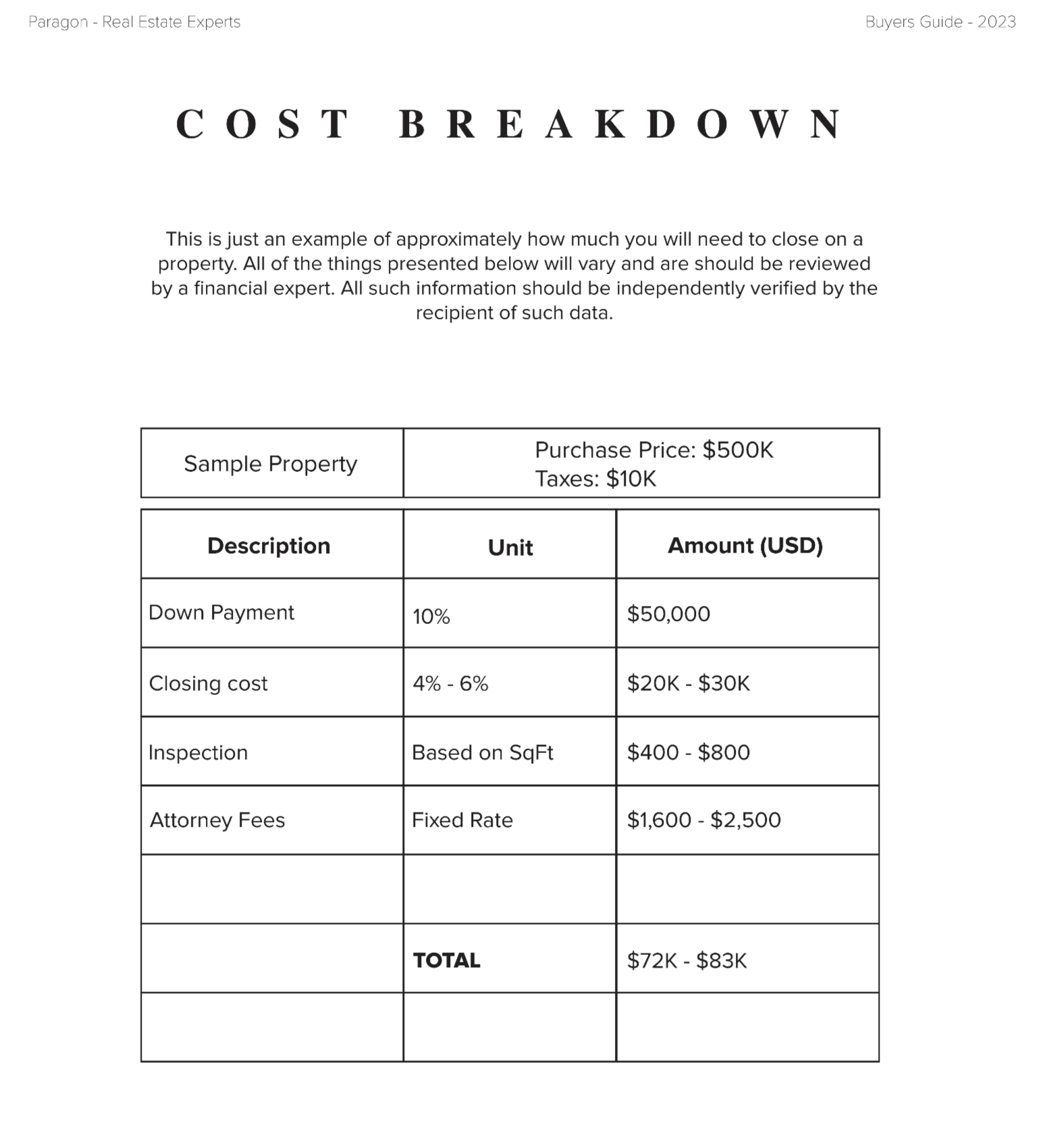

The amount of closing costs that buyers need to pay in NY can vary, but generally, closing costs can range from 4% to 6% of the purchase price of the property. For example, if you're purchasing a home in Levittown, NY, for $500,000, you can expect to pay between $20,000 and $30,000 in closing costs

- The Closing Fee, Settlement Fee, or Escrow Fee is paid to the company that handles the escrow account, earnest money, and closing process, such as an escrow company, title company, or real estate agent.

- The Credit Reporting Fee covers the cost of pulling a buyer's credit report during the underwriting process.

- Discount Points, paid upfront, reduce the amount of interest a buyer will pay over the life of the mortgage, with each point costing 1% of the loan amount and reducing the interest rate by 0.25%.

- Escrow Fees pay for the services of an escrow company, title company, or real estate attorney that facilitates the transaction of funds between the buyer and seller.

- FHA Mortgage Insurance is required for FHA loans, and includes an upfront payment of 1.75% of the loan value due at closing, as well as monthly mortgage insurance payments (MIP).

- Homeowners Insurance is required by the bank, and the buyer must pay one year's worth of insurance upfront at closing, with the cost varying based on the age, condition, size, and location of the house, as well as the level of coverage.

- The Loan Origination Fee covers the costs of administering and underwriting a mortgage, and typically costs 0.5%-1% of the total loan amount.

- Lender's Title Insurance is required by lenders to protect the amount they lend from undiscovered liens, errors, disputes, or other title problems.

- Owner's Title Insurance protects buyers from any claims or suits surrounding the property's title, and is purchased separately from the lender's policy.

- Private Mortgage Insurance (PMI) is required if the buyer puts less than 20% down on the loan, and protects the lender against the buyer defaulting on the loan.

- Property Taxes are prorated between buyer and seller depending on how much of the year each person owned the property.

- Rate Lock Fee, if charged by the lender, guarantees the interest rate will not rise if the loan closes within a set period of time.

- Real Estate Agent Commission is paid by the seller and typically amounts to 4%-6% of the sale price.

- The Recording Fee is a government fee to cover administrative costs.

Who Pays Closing Costs in NY: Buyer or Seller?

In NY, the responsibility for paying closing costs can vary depending on the contract between the buyer and the seller. In some cases, the seller may agree to pay a portion or all of the closing costs as part of the negotiation process. However, in most cases, the buyer is responsible for paying the closing costs.

What Is the Most Expensive Closing Cost?

The most expensive closing cost for homebuyers on Long Island, NY, is usually the mortgage-related fees. These can include loan origination fees, discount points, and mortgage insurance premiums. The exact amount of mortgage-related fees can vary depending on the type of mortgage, the lender, and other factors.

How Long Does It Take to Close on a House in NY?

The time it takes to close on a house in NY can vary, but generally, it takes between 45 and 65 days. However, the exact timeline can depend on several factors, such as the type of financing, the complexity of the transaction, and any contingencies or issues that arise during the process.

If you're planning to buy a home on Long Island, NY, it's important to be prepared for the closing costs associated with the purchase. To help you navigate the process, consider downloading my buyer's guide, which is available at therealtorjay.us/buyers-guide. With the right knowledge and preparation, you can make informed decisions and achieve a successful home purchase on Long Island, NY.

Conclusion

In summary, closing costs for homebuyers on Long Island, can include a variety of fees and expenses associated with the purchase of a property. The exact amount of closing costs can vary depending on several factors, but generally, buyers can expect to pay between 4% and 6% of the purchase price of the property. Buyers are typically responsible for paying the closing costs, but in some cases, the seller may agree to pay a portion or all of the closing costs. The most expensive closing cost is usually the mortgage-related fees, and the time it takes to close on a house in NY can vary between 45 and 65 days.

Disclaimer: All of the things presented here will vary and are should be reviewed by a financial expert. All such information should be independently verified by the recipient of such data.

Categories

Recent Posts

GET MORE INFORMATION

Agent